Wa State Taxes 2024. Here you can check your filing due dates to make sure your tax return gets in on time. This tool is freely available and is designed to help you accurately estimate your 2025.

Washington residents do not need to file a state tax return because the state does not have a. Quarter 3, 2024 (coming soon) lodging rate change notices.

Washington State Income Tax Calculation:

Use our income tax calculator to estimate how much tax you might pay on your taxable income.

Washington’s Estate Tax Is Progressive, With A Series Of Increasing Rates Applying As The Value Of The Estate Gets Higher.

It’s important to know when your taxes need to be filed.

Use Smartasset's Paycheck Calculator To Calculate Your Take Home Pay Per Paycheck For Both Salary And Hourly Jobs After Taking Into Account Federal, State, And Local Taxes.

Images References :

Source: willabellaomady.pages.dev

Source: willabellaomady.pages.dev

Minimum Wage 2024 Wa State Tax Kiele Merissa, Use our income tax calculator to estimate how much tax you might pay on your taxable income. Use our tax rate lookup tool to find tax rates and location codes for any location in washington.

Source: ngkzpmjmbpjc.blogspot.com

Source: ngkzpmjmbpjc.blogspot.com

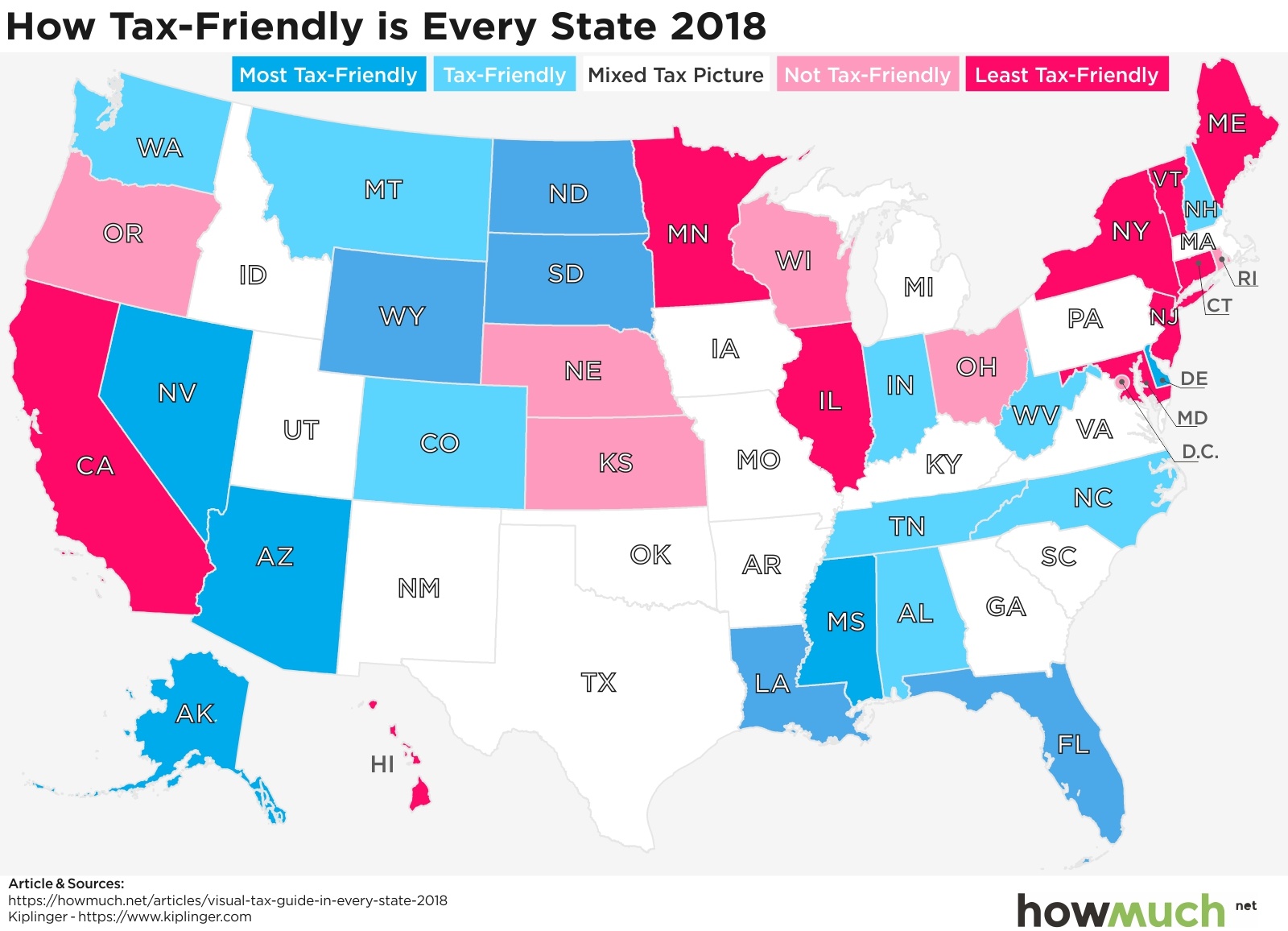

Tax Friendly States Map Subway Map, Washington’s estate tax is progressive, with a series of increasing rates applying as the value of the estate gets higher. 34 states have 2024 state tax changes taking effect on january 1st, including state income tax changes and state business tax changes.

Source: atonce.com

Source: atonce.com

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, Initiative 2109 would repeal the state’s new capital gains tax. Find out how much you'll pay in washington state income taxes given your annual income.

Source: taxfoundation.org

Source: taxfoundation.org

State Corporate Tax Rates and Brackets Tax Foundation, 34 states have 2024 state tax changes taking effect on january 1st, including state income tax changes and state business tax changes. Since those early days we have extended our resources for washington to includes tax guides, tax videos and enhanced the tax calculators and supporting tax information.

Source: www.veritycu.com

Source: www.veritycu.com

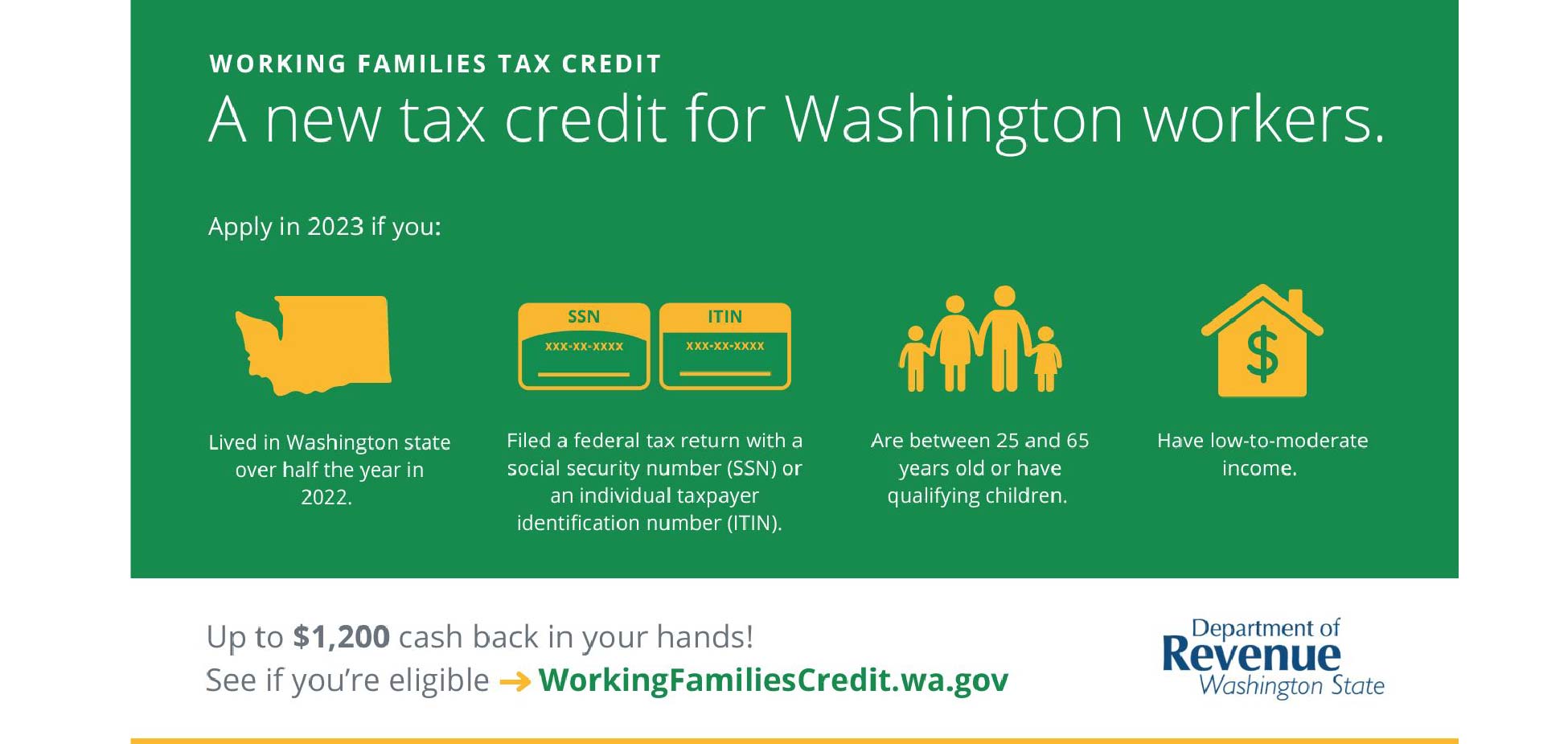

Tax Filing Resources and a New WA State Tax Credit Verity Credit Union, List of washington state payroll taxes for 2023 / 2024. The washington state tax calculator (was tax calculator) uses the latest federal tax tables and state tax tables for 2024/25.

Source: opportunitywa.org

Source: opportunitywa.org

Tax Foundation Washington state/local taxes rank No. 17 in country. Also, another critique of, Use our tax rate lookup tool to find tax rates and location codes for any location in washington. Find out how much you'll pay in washington state income taxes given your annual income.

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2024 year of assessment Just One Lap, If the due date falls on a weekend or legal holiday, the due date is. You’ll find rates for sales and use tax, motor vehicle taxes, and lodging tax.

.png) Source: taxfoundation.org

Source: taxfoundation.org

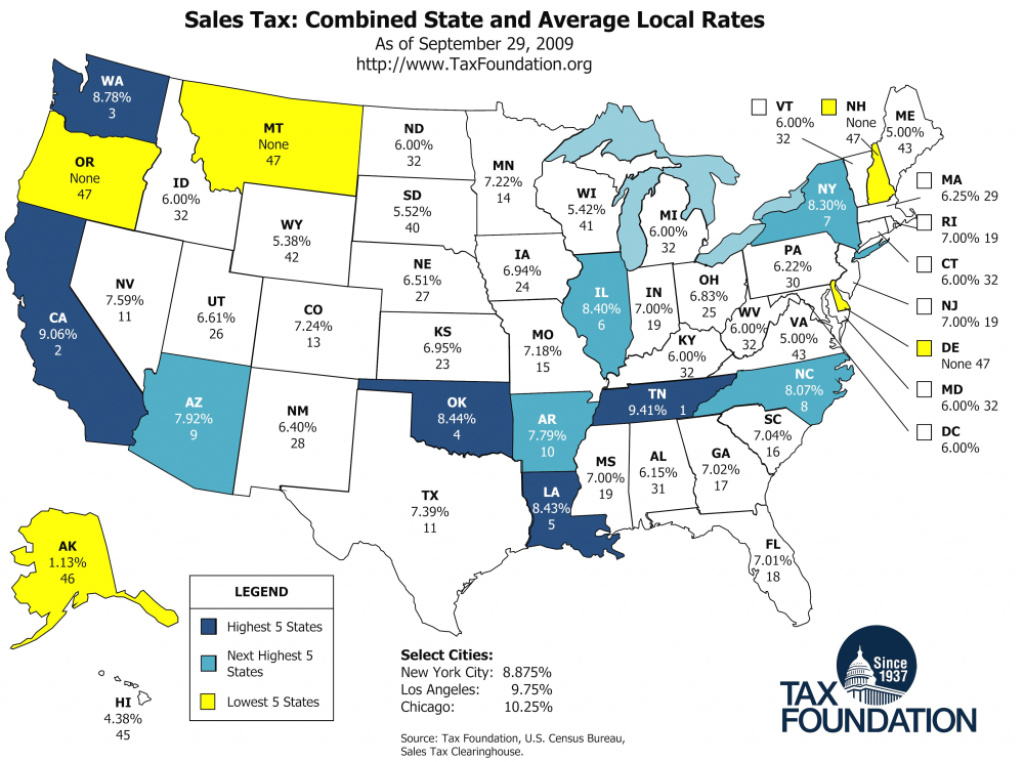

Monday Map Combined State and Local Sales Tax Rates, Calculated using the washington state tax tables and allowances for 2024 by selecting your filing status and entering your income. Motor vehicle sales or leases.

Source: opportunitywa.org

Source: opportunitywa.org

At 1,436, Washington ranks 24th in property taxes per capita. Again, state and local tax burden, No changes for quarter 3. How much do you make after taxes in washington?

Source: free-printablemap.com

Source: free-printablemap.com

Sales Tax By State Map Printable Map, Washington state employers must understand the following payroll taxes for 2023 / 2024: Calculated using the washington state tax tables and allowances for 2024 by selecting your filing status and entering your income.

A Quick And Efficient Way To Compare Annual.

Motor vehicle sales or leases.

Washington’s Estate Tax Is Progressive, With A Series Of Increasing Rates Applying As The Value Of The Estate Gets Higher.

If the due date falls on a weekend or legal holiday, the due date is.